Don’t get caught in the car hire trap!

Save money with single trip car hire excess insurance

Save up to £295 with a stand-alone car hire excess insurance policy, an alternative to costly car hire desk excess waivers^

^The average saving is based on a 40 year old UK resident renting a compact group c car from Madrid Airport airport for 14 days commencing 8th December 2025. Prices were obtained from six leading rental companies own websites on 1st December 2025 for the cost to reduce the damage excess to zero. The saving is based on the cost of a 14 day “Single Trip – UK & Europe cover” for the same period. This is a representative saving only, actual prices and savings may vary.

Single Trip Car Hire Excess Insurance

Our Which? Best Buy Single Trip Car Hire Excess Insurance is ideal for those going on one trip per year, with one or more consecutive rentals. We offer an annual car hire excess policy for frequent renters.

SINGLE TRIP

From £2.15 per day*

Covers you for one or more consecutive rentals for up to 180 days, with a total excess reimbursement of up to £10,000.

*price shown applies to cover in UK & Europe

What’s included as standard?

- £10,000 maximum excess reimbursement

- Up to 180 day single trip, with one or more consecutive rentals

- Up to 8 additional named drivers

- Tyres, windscreen, undercarriage

- £1000 misfuelling

- £1000 towing costs

- £1000 road rage & car jacking

- £500 key cover & lock out

- £300 personal possessions

- £300 curtailment of rental

- £300 drop off charges

- Loss of use

- UK & Europe cover

What are the optional extras?

- Worldwide cover

- Family cover

Key Exclusions & Eligibility Criteria

This policy is not suitable for you if any of the following apply. You are:

- A Non-UK Residents (Channel Islands and Isle of Man residents also excluded)

- Renting from Green Motion (all other rental companies are accepted)

- Renting a vehicle that is not a car, vans must be covered by a Van Hire Excess Insurance policy

- Renting a vehicle with more than 9 seats

- Renting a vehicle with a purchase value of over £65,000

- Renting a vehicle that is over 10 years old

- Driving off the Public Highway, including off-roading & safaris

- Aged under 21 or over 84

- Found to have caused loss, damage or injury to third parties or their property as this is normally covered by your hire company’s Supplementary Liability Insurance (SLI).

Looking for Single Trip Van Hire Excess Insurance?

Covers you and up to eight additional drivers named on the rental agreement, for up to 31 days in the UK.

Our Van hire excess insurance does not cover business use, or trips outside the UK.

Save money & stop paying hire company excess waivers

Hire companies will try to upsell you an optional excess waiver to reduce your excess to zero in the event of damage to the hire car.

However, these hire company excess waivers can more than double the cost of your car hire.

A policy from ReduceMyExcess is typically a fraction of the cost, saving you hundreds on your car hire, and keeping your excess fully protected.

ReduceMyExcess believe hiring a car should be simple

We know hiring a car is stressful, that’s why we’re making it easier.

Simply purchase your car hire excess insurance (excess reimbursement) policy, then refuse any hard-sell excess waiver fees at the hire desk knowing you’re already covered.

Need to know more?

Please read on…

Car hire excess insurance (also known as Excess Reimbursement Insurance) is a lot less scary than it sounds and if you ever have to hire a car, it could save you money in the process.

At its most basic level, our car hire excess insurance (a Which? Best Buy) is an insurance policy that you take out which allows you to be reimbursed the amount of excess you have had to pay to a car hire company if you accidentally damage your hire car.

Generally in the car hire industry, UK and European car hire agreements will usually automatically include CDW (Collision Damage Waiver), theft and third-party liability which covers the full value of the car and any damage to a third party in the event of an accident.

This means that if you end up damaging the vehicle, or causing damage to something else, you only need to pay out up to the excess limit, and the car hire companies own insurance will cover the remainder. However, the excess alone can still amount to £1,500 or more.

Excess Reimbursement Insurance

With a policy from ReduceMyExcess we’ll reimburse the excess you’ve had to pay once you’ve claimed through us, meaning you shouldn’t have to pay a penny in excess at all.

And even better – you don’t have to take out the hire company’s expensive excess waiver, saving you hundreds on the cost of car hire straight away.

Car hire excess insurance isn’t mandatory, it’s not like car insurance and it isn’t a legal requirement when you hire a car.

Having said that, what car hire excess insurance does give you is protection and peace-of-mind that should you cause any accidental damage to your hire car you can claim through us and not let it ruin your holiday.

In addition, having a ReduceMyExcess policy means you can refuse the hire company’s own excess reduction fees, which can add hundreds to the cost of car hire.

ReduceMyExcess are a Which? Best Buy insurer two years running, and Feefo Platinum Trusted Award five years in a row.

With over a decade’s worth of experience in the industry, here at ReduceMyExcess we pride ourselves on providing a low-cost alternative to expensive excess waivers offered to you by car hire companies.

Our goal is to consistently put our customers first and provide the best possible service we can, whilst constantly finding new ways to help you save money on car hire excess fees.

Our policies are underwritten by globally renowned insurers AIG who recently won “Outstanding Insurer of the Year” at the LifeSearch awards and operate in over 80 countries globally, so you know you’ll be in excellent hands.

We offer two main types of policies:

Our single trip policy (as its name suggests) is best for people planning a single trip away, even if you’re hiring multiple times during the trip, as long as your hires are consecutive.

Our annual cover is more suited to people who are going away more than once a year, with gaps between hires.

Geographically, our cover is also split up into three sections:

- UK and Europe

- Worldwide

- Worldwide+

Our UK and Europe cover extends to Europe only, our worldwide cover includes the rest of the world. Worldwide+ adds CDW cover for those visiting USA and Canada, where CDW is often not included within the cost of the rental.

We know that car hire excess insurance policies can be confusing, especially if you’re new to them. That’s why we’ve put together some helpful guides about some of the main policy benefits when you take out cover from us:

- Tyres, Windscreen and Undercarriage Cover

- Family Cover

- Personal Possessions Cover

- Misfuelling Cover

- Key Cover

- Towing Costs Cover

- Any rentals from Green Motion (all other rental companies are accepted)

- Any Vehicle that is not a car

- Vans must be covered by a Van Hire Excess Insurance policy

- Vehicles with more than 9 seats

- Vehicles with a purchase value of over £65,000

- Vehicles that are over 10 years old

- Driving off the Public Highway, including off-roading & Safaris

- Loss, damage or injury to third parties or their property

- Drivers aged under 21 or over 84

- Non-UK Residents

*4x4s are covered for road use only. Off-road use is not covered.

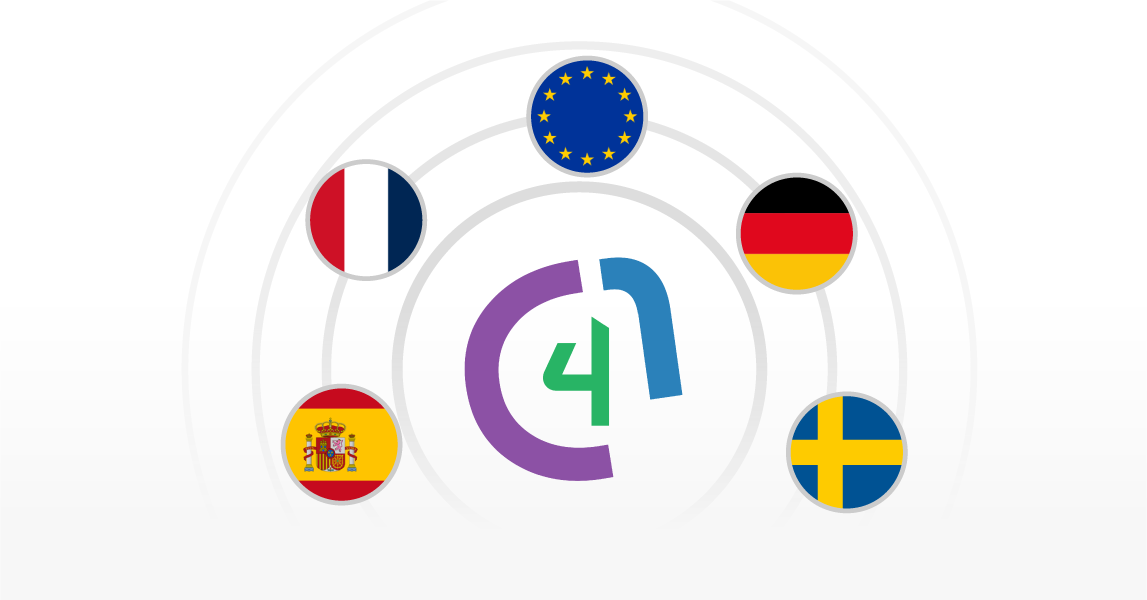

Not a UK resident? Don’t worry, we have a site for EU residents too

ReduceMyExcess is for UK residents. For EU residents, please visit our sister-brand Cover4Rentals.

ReduceMyExcess covers a wide range of hire cars

We cover the excess on hire cars up to the value of £65,000, no older than 10 years and with no more than nine seats – including 4x4s for road use.

In addition to damage, we also cover windscreen, tyres, undercarriage and administration costs that you may be charged against your excess.

Vans can be covered separately with our single trip van hire excess insurance policy.

Car hire excess insurance policy features

Standard cover limit of up to £10,000 for excess reimbursement (including admin fees).

What is UK & Europe car hire excess insurance cover from ReduceMyExcess?

The first of our geographical car hire excess options is our UK and Europe cover. Unlike our worldwide options, this cover will only provide you with car hire excess insurance within the UK or across Europe.

It is our most affordable cover when compared to worldwide (for obvious reasons) and one of our most popular choices among our customers.

Where will I be covered with a UK & Europe car hire excess insurance policy?

Let’s first deal with the UK aspect of the cover. For our UK & Europe cover your hire car will be protected anywhere within the United Kingdom (England, Wales, Scotland and Northern Ireland including the Isle of Wight and Isle of Man.

When it comes to Europe, you’ll be covered in the following countries and principalities:

Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland and the United Kingdom.

We also include the Channel Islands and the Isle of Man, Azores, the Canary Islands, Islands in the Mediterranean and Madeira.

How do I add additional drivers to my policy?

You don’t need to tell us or change your policy with us in anyway to cover additional drivers for your hire vehicle.

As the policy holder, as long as you are the lead driver on your hire agreement, up to eight additional named drivers on your rental agreement will automatically be covered by your policy.

The cover includes damage to the tyres, windscreens, all auto glass, undercarriage, misfuelling and towing costs of the rental vehicle.

Covers up to £1,000 towards costs if you put the wrong fuel into the rental vehicle.

What are towing costs for a hire car?

Towing costs are as simple as they sound, they’re essentially and amount of money to have to pay a recovery company to collect your stricken hire car.

They can vary drastically in amounts depending on which country you use and what kind of recovery company you use.

When would I have to pay towing costs for a hire car?

You’ll often pay them up front, or even before the recovery vehicle has assisted you.

Depending on what country you’re in you may even need to pay in cash, so make sure you have a good amount on you. However, remember that you’ll need a receipt so make sure you get one, regardless of how you pay.

How can I get reimbursed for hire car towing costs?

Once your rental period is over, you can begin claiming back any towing costs through our claims process up to a total of £1000.

Make sure you keep all records of what you paid including receipts and/or invoices from any recovery agents.

What are the exclusions?

Unfortunately we can’t cover towing costs if it isn’t as a result of an accident, damage to the car or a breakdown.

Towing costs will only be covered as long as the car is taken to the car hire company premises or your pick-up location, whichever is closest. If you get towed anywhere else then those costs incurred won’t be deductible.

For those situations that become out of your control, you’ll be covered for third party road rage and carjacking up to £1,000.

In relation to car hire excess insurance, key cover is the benefit of being reimbursed the amount charged by the hire company if you lose your car keys or have them stolen.

Car key insurance cover provides peace of mind when renting a car abroad, as you know that if you get locked out of your car, misplace the keys or suspect they have been stolen, you will be able to claim back the costs and not end up out of pocket.

When you take out a policy with ReduceMyExcess, car key insurance cover is included.

How does hire car key insurance work as part of car hire excess insurance?

Key cover, like many other aspects of car hire excess insurance, works on a reimbursement basis. You’ll be due back any costs incurred as a result of you or any additional drivers being locked out of your rental vehicle as well as costs due for replacing lost or stolen keys.

You will be able to reclaim this money once you’ve returned your rental vehicle and your hire period has finished. So make sure you keep any receipt or invoice that shows the amount you had to pay in order to gain access to your rental car.

What does hire car key insurance cover as part of car hire excess insurance?

- The cost of emergency car key replacement

- Locksmith charges (up to £100)

What doesn’t it cover?

If your car key replacement costs more than £500, or the locksmith charges are more than £100, you will not be able to fully recoup your losses.

For additional drivers to also benefit from key cover they will need to be named on the car rental agreement and be between the ages of 21 and 84.

What do I do if I’ve lost my hire car key?

Don’t panic!

It can seem like a terrible and hopeless situation to be locked out of your car, potentially in a foreign country, where you don’t speak the local language, but it will get sorted.

The first thing to do is phone your car hire company as not only do you need their permission to have the car broken into by a locksmith, but they can also assist with arranging a locksmith for you.

All car hire companies have spare keys for their vehicles and so after your locksmith has been called and gained access, you should drive directly to where you collected the car from and acquire a spare key. You may be charged now for the spare key, or at the end of your rental contract.

Either way, make absolutely sure that you record every payment that you’ve been charged. You can then use your lost car key insurance to claim it back from us afterwards.

What is personal possessions cover as part of car hire excess insurance?

Simply put, personal possessions cover allows you to be reimbursed up to a certain amount for items that belong to you if they have been stolen from your locked rental vehicle.

Because this aspect of car hire excess insurance usually means a crime has been committed, the claims process can be a bit more detailed and confusing, but this policy benefit is really helpful, especially for people hiring in a foreign country when you can often feel even more helpless when you’re the victim of a crime.

Items you can claim for are generally any luggage, personal effects that you normally wear and clothing, but you can find out more about what exactly you’re covered for in the exclusions section below.

How does personal possessions cover work as part of car hire excess insurance?

Personal possessions cover works through a reimbursement process, once you submit your claim with all the relevant documents you need (check out our claims section for more details) then our claims handlers will go about calculating how much you’ll be given.

For a ReduceMyExcess policy, you’ll be reimbursed up to £75 per item, up to a total of £300 for the length of your policy. (So, for example you will only ever receive £300 reimbursement per year for an annual policy.)

Car key insurance cover provides peace of mind when renting a car abroad, as you know that if you get locked out of your car, misplace the keys or suspect they have been stolen, you will be able to claim back the costs and not end up out of pocket.

If you have to return your vehicle early due to illness or another emergency, then you’ll be reimbursed up to £300 for the days you lose.

If, due to an accident or illness resulting in your hospitalisation, you need to return your car to a different branch to the one you picked it up from, you’ll be covered up to £300 towards the charges incurred from this.

Covers for the loss of use of the rental vehicle, whilst its not available to hire, due to damage.

What is Worldwide Cover from ReduceMyExcess?

Worldwide car hire excess cover is exactly how it sounds.

Unlike our UK & Europe cover options, there are fewer restrictions on where you can hire a car and still be protected whilst driving it.

You might think that worldwide cover means that anywhere in the world you choose to hire a car, you’ll be covered for, but unfortunately we can’t provide protection in every single country.

With Worldwide Cover you will be covered in all the countries covered by our UK & Europe cover:

Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland and the United Kingdom.

Plus all other countries with the exception of:

Afghanistan, Belarus, Crimea/Ukraine, Cuba, Iran, Iraq, Ivory Coast, Liberia, North Korea, Myanmar, Republic and the Democratic Republic of Congo, Russia, Sudan, Syria, Venezuela and Zimbabwe.

In addition, if there is a Foreign and Commonwealth Office travel advisory against all but essential travel to a country, then we won’t be able to cover you there.

What is Worldwide Plus cover from ReduceMyExcess?

Our Worldwide Plus hire car excess reimbursement insurance is our most complete cover we offer, not only does it include every country covered by our UK & Europe, and Worldwide cover, but it also includes added protection when renting in the USA and Canada.

Wordwide Plus includes Collision Damage Waiver (CDW) cover for hire cars

CDW is most commonly already included with most European rentals (but do check with the rental company). It is effectively the same as normal car insurance in the UK. You wouldn’t be allowed to drive the hire car without it. The excess, for any damage is what ReduceMyExcess normally cover you for, so CDW cover isn’t always needed.

However, for rentals in the Canadian and US, CDW is most commonly an optional extra sold at the hire desk. If you don’t take any CDW cover out, then you’re liable for the cost of the whole vehicle should it be damage.

Lots of people will in the US and Canada will already have a third party covering their CDW (like a credit card company, for instance) but as a traveller to these countries you may need to arrange CDW with a specialist like ReduceMyExcess to remain fully protected.

How do I know if I need CDW cover?

You will need to read your rental agreement and check with your hire company to make sure CDW is included within the cost of rental. If it is not, then purchasing ReduceMyExcess Worldwide Plus cover will reimburse you up to $50,000 (CDW), as well cover the cost of the excess should the hire car be damaged.

What is Family Cover for car hire excess insurance?

One of the really great things about our car hire excess cover is the ability for our customers to add multiple people to their policy through family cover.

Family cover means that you can add people who live at your address to your policy, and they will be covered by your policy whenever they’re the lead driver on a rental agreement. In addition, up to eight other named drivers on their rental agreement will also be covered.

Testimonials

How it works

1. Choose your cover

Single trip or annual cover, optional family and CDW cover

2. Get insured instantly

Get covered fast and join a community of 250,000+ customers, backed by AIG

3. Drive with confidence

Protect your excess and save hundreds on the cost of car hire at the same time

Check out our prices

Protect your wallet with ReduceMyExcess